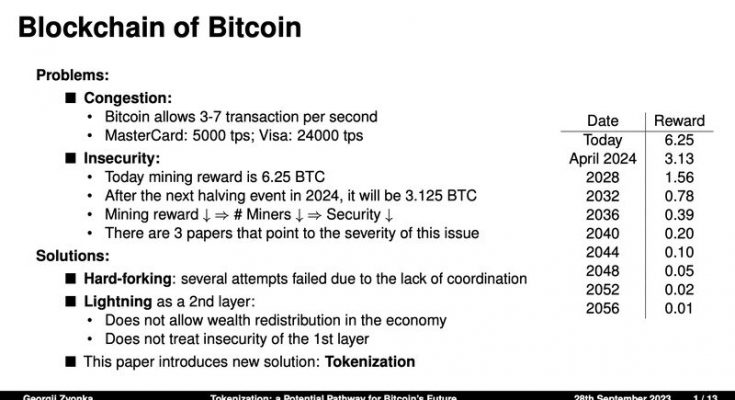

The paper introduces tokenization as a way to overcome the problems of Bitcoin, which may become even more prominent after the next mining reward #halving, scheduled for April 2024. I focus on the role the tokens can play in transitioning from one monetary standard to another. The money we are currently adhering to made a long path in its evolution: [barter money] -> [commodity money] -> [fiat money]. But most of the time, the transition was happening under the supervision of some authority implementing the changes and legally enforcing the society to adopt them. In the case of decentralized Bitcoin, there is no such authority, so there is a big question about the ability of decentralized currencies to evolve and update themselves. When Bitcoin reached the limits of its blockchain for the first time in 2017, a few dozen hard forks appeared. Still, none replaced the original cryptocurrency as the society failed to coordinate its transition to one of them. My paper shows that Bitcoin can evolve with the help of tokenization and that no enforcement is required to induce the adoption of the new monetary standard. The possibility of Bitcoin to self-update explains its high value despite the blockchain congestion and long-term security issues.

Georgii Zvonka wins best junior paper award at CEQURA Conference 2023